May 19

Few more international than West Seti (eKantipur.com)

May 20

Maoists up land grab drive (eKantipur.com)

Global Bank aims to tap rural market (eKantipur.com)

Mero Mobile now in Janakpur (eKantipur.com)

Wlink's new offers (eKantipur.com)

Buddha Air acquires new aircraft; NIC operating profit up 50 pc (eKantipur.com)

Share market grows unabated (Nepalnews.com)

May 21

JTMMs step up land seizures (eKantipur.com)

Severn Trent withdraws bid (eKantipur.com)

Quality control effort hits snag (eKantipur.com)

IFC extends $2m to BoK (eKantipur.com)

Cement black market thrives (eKantipur.com)

Commerce minister rules out petro price hike (Nepalbiznews.com)

May 22

Melamchi is dead (eKantipur.com)

Wheat production up by 8.68 percent (eKantipur.com)

‘China to restore Kodari highway’ (eKantipur.com)

IOC slashes petroleum supply (eKantipur.com)

IFC partners with BoK on Trade Finance and SME Development (Nepalnews.com)

Severn Trent withdrew without consulting ADB (Nepalnews.com)

May 23

Melamchi: Yet another Arun III (eKantipur.com)

Indo-Nepal brand war intensifies (eKantipur.com)

Coffee export picks up (eKantipur.com)

Handicraft export comes down by 4.65 pc (eKantipur.com)

IOC cuts petro supply again, nation set to face fuel crisis (Nepalnews.com)

May 24

IOC demands Rs 1b for normal supply, Govt to extend Rs 500m to NOC (eKantipur.com)

Nepal, Hong Kong review air service (eKantipur.com)

Effort stressed to maintain tea quality (eKantipur.com)

Break up syndicate in transportation: CNI (eKantipur.com)

IOC demands Rs 1 billion for normal supply of petro products (Nepalbiznews.com)

May 25

NOC cuts corners on safe storage (eKantipur.com)

PE losses stand at Rs 41b (eKantipur.com)

Nepali entrepreneurs to participate in tea & coffee world cup (Nepalnews.com)

May 26

Govt extends Rs 1b loan to NOC (eKantipur.com)

Lukewarm response to 3G (eKantipur.com)

Carpet export sees another decline (eKantipur.com)

Upcoming budget to be business friendly (eKantipur.com)

Govt to buy aircraft for NAC (eKantipur.com)

May 27

Schools to open, talks between teachers and Ministry called off (Nepalnews.com)

Monday, May 28, 2007

PE losses stand at Rs 41 billion

PE losses stand at Rs 41 billion

eKantipur.com, 25-May-07

The government has incurred a cumulative loss of Rs 45.16 billion in the operation of 21 state-owned enterprises by the end of fiscal year 2005/06.

“The loss incurred in these institutions were more than four times of share investments that the government has made into these enterprises,” said Bachchu Ram Dahal, acting auditor general, speaking at the meeting of the Public Account Committee (PAC) in the Interim-Legislature Parliament on Friday.

The government had made a share investment of Rs 10.86 billion in these 21 institutions while its total investment on all the 99 state-owned and semi-government institutions stood at Rs 51.54 billion.

He also informed that most of the state-owned institutions such as Nepal Airlines Corporations (NAC), Transport Corporation, Nepal Rosin and Turpentine and Rural Housing Company have not audited their accounts regularly.

Likewise, 10 other state-owned institutions have not audited their account for last 22 years.

According to Dahal, the Nepal Electricity Authority (NEA) alone has already incurred a cumulative loss of over Rs 5 billion whereas NAC's losses stand at over Rs 2.5 billion. The annual loss of NEA is around Rs 2 billion.

Top officials of NEA blamed wrong decisions and policies adopted by the then governments for the mounting loss. "The then government decision to purchase power from Khimti and Bhotekoshi Power Projects at high prices were the major cause behind the huge losses incurred by NEA," he said.

In addition, NEA has to recover over Rs 1.6 billion arrears from local bodies for street lamps. "The government should take immediate initiatives to recover the arrears and reduce losses," he said.

Gautam Das Shrestha, managing director of NAC, said that the then government's decision to lease an aircraft from Lauda Air in 2000 alone caused the NAC a huge loss of Rs 1 billion.

Dahal said that due to the weak internal control mechanism, lack of internal auditing, inability to utilize the full capacity of the institutions and increasing production costs were the main causes behind the huge losses in the public enterprises.

eKantipur.com, 25-May-07

The government has incurred a cumulative loss of Rs 45.16 billion in the operation of 21 state-owned enterprises by the end of fiscal year 2005/06.

“The loss incurred in these institutions were more than four times of share investments that the government has made into these enterprises,” said Bachchu Ram Dahal, acting auditor general, speaking at the meeting of the Public Account Committee (PAC) in the Interim-Legislature Parliament on Friday.

The government had made a share investment of Rs 10.86 billion in these 21 institutions while its total investment on all the 99 state-owned and semi-government institutions stood at Rs 51.54 billion.

He also informed that most of the state-owned institutions such as Nepal Airlines Corporations (NAC), Transport Corporation, Nepal Rosin and Turpentine and Rural Housing Company have not audited their accounts regularly.

Likewise, 10 other state-owned institutions have not audited their account for last 22 years.

According to Dahal, the Nepal Electricity Authority (NEA) alone has already incurred a cumulative loss of over Rs 5 billion whereas NAC's losses stand at over Rs 2.5 billion. The annual loss of NEA is around Rs 2 billion.

Top officials of NEA blamed wrong decisions and policies adopted by the then governments for the mounting loss. "The then government decision to purchase power from Khimti and Bhotekoshi Power Projects at high prices were the major cause behind the huge losses incurred by NEA," he said.

In addition, NEA has to recover over Rs 1.6 billion arrears from local bodies for street lamps. "The government should take immediate initiatives to recover the arrears and reduce losses," he said.

Gautam Das Shrestha, managing director of NAC, said that the then government's decision to lease an aircraft from Lauda Air in 2000 alone caused the NAC a huge loss of Rs 1 billion.

Dahal said that due to the weak internal control mechanism, lack of internal auditing, inability to utilize the full capacity of the institutions and increasing production costs were the main causes behind the huge losses in the public enterprises.

Nepal, Hong Kong review air service

Nepal, Hong Kong review air service

eKantipur.com, 24-May-07

Nepal has reviewed air service agreement (ASA) with Hong Kong at a two-day bilateral aviation meeting that concluded there on Wednesday.

The review, which allows 14 passenger flights each week from each destination, is aimed at clearing the way for new airlines to conduct flights between Kathmandu and the Chinese special administrative region.

As of now, both Nepal and Hong Kong are enjoying facility of operating flights having up to 900 air seats per week.

“Beside, the ASA review permits unlimited number of air cargo flights between the two destinations,” said Dinesh Hari Adhikari, joint secretary at the Ministry of Culture, Tourism, and Civil Aviation (MoCTCA).

Currently, Nepal Airlines Corporation (NAC) is the only airline operating flights to Hong Kong. Cathay Pacific has already announced that it would start flights from Hong Kong to Kathmandu. But, it has not disclosed when those will commence.

“With the review in the ASA, airlines from Nepal and Hong Kong may serve five intermediate and five beyond points without fifth freedom rights,” said Adhikari.

Madhav Prasad Ghimire, secretary at the MoCTCA led the Nepali delegation during the meeting while Albert Tang, principal assistant secretary at Economic Development and Labor Bureau headed the Hong Kong delegation.

He said the ASA review with Hong Kong was necessary to pave the way for additional flights from new private airlines in Nepal. “Of the total 900 weekly seats available for Nepal, the national flag carrier uses 600 seats. So, there were no adequate air seats for other private airlines,” he said.

Nepal has signed ASAs with nearly three dozen countries. However, it has direct flights with only around a dozen countries.

eKantipur.com, 24-May-07

Nepal has reviewed air service agreement (ASA) with Hong Kong at a two-day bilateral aviation meeting that concluded there on Wednesday.

The review, which allows 14 passenger flights each week from each destination, is aimed at clearing the way for new airlines to conduct flights between Kathmandu and the Chinese special administrative region.

As of now, both Nepal and Hong Kong are enjoying facility of operating flights having up to 900 air seats per week.

“Beside, the ASA review permits unlimited number of air cargo flights between the two destinations,” said Dinesh Hari Adhikari, joint secretary at the Ministry of Culture, Tourism, and Civil Aviation (MoCTCA).

Currently, Nepal Airlines Corporation (NAC) is the only airline operating flights to Hong Kong. Cathay Pacific has already announced that it would start flights from Hong Kong to Kathmandu. But, it has not disclosed when those will commence.

“With the review in the ASA, airlines from Nepal and Hong Kong may serve five intermediate and five beyond points without fifth freedom rights,” said Adhikari.

Madhav Prasad Ghimire, secretary at the MoCTCA led the Nepali delegation during the meeting while Albert Tang, principal assistant secretary at Economic Development and Labor Bureau headed the Hong Kong delegation.

He said the ASA review with Hong Kong was necessary to pave the way for additional flights from new private airlines in Nepal. “Of the total 900 weekly seats available for Nepal, the national flag carrier uses 600 seats. So, there were no adequate air seats for other private airlines,” he said.

Nepal has signed ASAs with nearly three dozen countries. However, it has direct flights with only around a dozen countries.

Handicraft export comes down by 4.65 percent

Handicraft export comes down by 4.65 percent

eKantipur.com, 23-May-07

The export of handicraft goods from Nepal fell by 4.65 percent in the first three quarters of the current fiscal year.

Data compiled by Federation of Handicraft Associations of Nepal (FHAN) shows that Rs 2.02 billion worth of handicraft were exported in the first nine months of 2006/07, as against Rs 2.12 billion in same period last fiscal year.

However, export in the ninth month of the current fiscal year was marginally higher than the export in the same period last year, with recording a 2.72 percent rise.

The dip is attributed largely to slump in export of pashmina products, metal craft and handmade paper which together contributed 41 percent of all handicraft exports from Nepal.

Slump in export of pashmina products, which make up 19 percent of the total handicraft exports, continues.

A total of Rs 359.94 million worth of pashmina products were exported in the nine months of this fiscal year. It is down by 18.56 percent compared to the same period last year. The country had exported pashmina worth of over Rs 5.6 billion six years ago.

FHAN officials said that pashmina export suffered mostly from tough competition by Chinese and Indian products and also its inability to adapt to new market trends and develop new products.

The recently launched 150 new patterns and designs by Pashmina Product Development Committee, a unit of Handicraft Design and Development Center is expected to fill the gaps in this regard.

Similarly, export of metal craft fell down by 12.47 percent to Rs 276.5 million while handmade paper products marked a 10.26 percent decrease in export to Rs 175.04 million in the first nine months of the current fiscal year.

The export of woolen goods came down by 27.47 percent this year. This was attributed to the separation of felt product export from the category of woolen goods.

“We used to include felt products under woolen goods. But with their rising export, the federation decided to file it separately,” said Krishna Hada of FHAN, elaborating the reason behind decline.

In the first three quarters during the previous year, the woolen goods and felt products brought in Rs 496. 29 million worth of foreign currency while in the same period this year they sold for Rs 359.94 million and Rs 155.55 million respectively bringing the combined export to Rs 515.51 million. This is 26 percent of the total handicraft export.

But officials at FHAN said that the dip is not significant enough to cause worries.

“An increase or decrease of less than 10 percent does not mean much to the industry. The difference in the first eight months was 5.44 percent and now it is 4.65 percent. I expect this year's exports to be on par with last year's by the end of the fiscal year,” Dilip Khanal, executive secretary of FHAN told the Post.

eKantipur.com, 23-May-07

The export of handicraft goods from Nepal fell by 4.65 percent in the first three quarters of the current fiscal year.

Data compiled by Federation of Handicraft Associations of Nepal (FHAN) shows that Rs 2.02 billion worth of handicraft were exported in the first nine months of 2006/07, as against Rs 2.12 billion in same period last fiscal year.

However, export in the ninth month of the current fiscal year was marginally higher than the export in the same period last year, with recording a 2.72 percent rise.

The dip is attributed largely to slump in export of pashmina products, metal craft and handmade paper which together contributed 41 percent of all handicraft exports from Nepal.

Slump in export of pashmina products, which make up 19 percent of the total handicraft exports, continues.

A total of Rs 359.94 million worth of pashmina products were exported in the nine months of this fiscal year. It is down by 18.56 percent compared to the same period last year. The country had exported pashmina worth of over Rs 5.6 billion six years ago.

FHAN officials said that pashmina export suffered mostly from tough competition by Chinese and Indian products and also its inability to adapt to new market trends and develop new products.

The recently launched 150 new patterns and designs by Pashmina Product Development Committee, a unit of Handicraft Design and Development Center is expected to fill the gaps in this regard.

Similarly, export of metal craft fell down by 12.47 percent to Rs 276.5 million while handmade paper products marked a 10.26 percent decrease in export to Rs 175.04 million in the first nine months of the current fiscal year.

The export of woolen goods came down by 27.47 percent this year. This was attributed to the separation of felt product export from the category of woolen goods.

“We used to include felt products under woolen goods. But with their rising export, the federation decided to file it separately,” said Krishna Hada of FHAN, elaborating the reason behind decline.

In the first three quarters during the previous year, the woolen goods and felt products brought in Rs 496. 29 million worth of foreign currency while in the same period this year they sold for Rs 359.94 million and Rs 155.55 million respectively bringing the combined export to Rs 515.51 million. This is 26 percent of the total handicraft export.

But officials at FHAN said that the dip is not significant enough to cause worries.

“An increase or decrease of less than 10 percent does not mean much to the industry. The difference in the first eight months was 5.44 percent and now it is 4.65 percent. I expect this year's exports to be on par with last year's by the end of the fiscal year,” Dilip Khanal, executive secretary of FHAN told the Post.

Wednesday, May 23, 2007

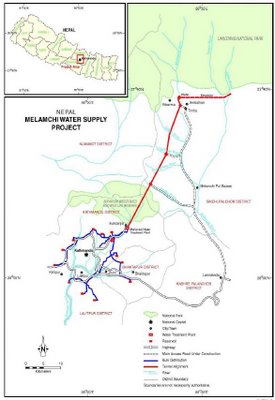

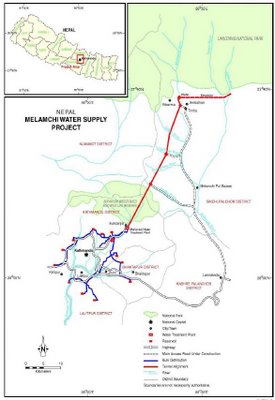

Melamchi is dead: Unable to continue after June 30: ADB

Melamchi is dead: Unable to continue after June 30: ADB

eKantipur.com, 22-May-07

BY BIKASH SANGRAULA

Six years after entering construction, Melamchi, the country's largest development project, met a sad demise Tuesday, with the Asian Development Bank (ADB), the project's principal donor, saying it cannot extend its loan commitment to the project.

"As it stands now, it would not be possible to carry on with project activities, with the project closing on 30 June 2007. In such difficult circumstances, it is now for the government to decide how it wishes to proceed," said ADB in a statement issued Tuesday, a day after withdrawal by UK firm Severn Trent Water International (STWI) of a contract bid to manage Kathmandu Valley's water supply.

Appointment of a management contractor was a critical covenant in ADB's funding commitment to the project. After Minister of Physical Planning and Works Hisila Yami halted the contract award on May 8, the bank had repeatedly urged the government to award it, stating that without it the bank would be unable to extend its funding commitment. A cabinet meeting in the previous government had decided to award the contract to STWI, which was the sole bidder.

"A key provision of the loan agreement signed between the Government of Nepal and ADB on 24 January 2001 was that the restructuring of Nepal Water Supply Corporation and award of a private sector management contract for delivery of water services under competitive procedures must be completed prior to initiation of civil works contracting for the construction of the diversion tunnel from Melamchi Valley to Kathmandu," the bank said in the statement.

This provision of the loan agreement recognized that the chronic water shortages affecting Kathmandu are caused not only by lack of supply infrastructure and bulk water resources, but also by poor management of water services, the Bank has added in the statement.

"The signing of the private management contract was the very last stage of a long process to achieve the agreed institutional reform for efficient utilization of Melamchi's water. This long process, which has required six years of effort, cannot be completed now that the water utility operator is unable to obtain approval from the Government to sign the duly negotiated contract and the final bid validity has been withdrawn on 15 May 2007 (after nine extensions made since March 2006)," the bank has further said.

Melamchi project, which was scaled down from the original estimated cost of US $ 464 million to US $ 350 million in March this year, was designed to supply 170 million liters of water daily from Melamchi River in Sindhupalchowk district to Sundarijal in Kathmandu through a 26.5-km diversion tunnel. ADB had committed US $ 165 million to the project.

The daily demand of water in Kathmandu Valley is 250 million liters, while the supply is less than one-third the demand.

Source: Melamchi Water Supply (pdf), Asian Development Bank

eKantipur.com, 22-May-07

BY BIKASH SANGRAULA

Six years after entering construction, Melamchi, the country's largest development project, met a sad demise Tuesday, with the Asian Development Bank (ADB), the project's principal donor, saying it cannot extend its loan commitment to the project.

"As it stands now, it would not be possible to carry on with project activities, with the project closing on 30 June 2007. In such difficult circumstances, it is now for the government to decide how it wishes to proceed," said ADB in a statement issued Tuesday, a day after withdrawal by UK firm Severn Trent Water International (STWI) of a contract bid to manage Kathmandu Valley's water supply.

Appointment of a management contractor was a critical covenant in ADB's funding commitment to the project. After Minister of Physical Planning and Works Hisila Yami halted the contract award on May 8, the bank had repeatedly urged the government to award it, stating that without it the bank would be unable to extend its funding commitment. A cabinet meeting in the previous government had decided to award the contract to STWI, which was the sole bidder.

"A key provision of the loan agreement signed between the Government of Nepal and ADB on 24 January 2001 was that the restructuring of Nepal Water Supply Corporation and award of a private sector management contract for delivery of water services under competitive procedures must be completed prior to initiation of civil works contracting for the construction of the diversion tunnel from Melamchi Valley to Kathmandu," the bank said in the statement.

This provision of the loan agreement recognized that the chronic water shortages affecting Kathmandu are caused not only by lack of supply infrastructure and bulk water resources, but also by poor management of water services, the Bank has added in the statement.

"The signing of the private management contract was the very last stage of a long process to achieve the agreed institutional reform for efficient utilization of Melamchi's water. This long process, which has required six years of effort, cannot be completed now that the water utility operator is unable to obtain approval from the Government to sign the duly negotiated contract and the final bid validity has been withdrawn on 15 May 2007 (after nine extensions made since March 2006)," the bank has further said.

Melamchi project, which was scaled down from the original estimated cost of US $ 464 million to US $ 350 million in March this year, was designed to supply 170 million liters of water daily from Melamchi River in Sindhupalchowk district to Sundarijal in Kathmandu through a 26.5-km diversion tunnel. ADB had committed US $ 165 million to the project.

The daily demand of water in Kathmandu Valley is 250 million liters, while the supply is less than one-third the demand.

Source: Melamchi Water Supply (pdf), Asian Development Bank

Global Economy. Southern Transnationals: The New Kids on the Block?

Global Economy. Southern Transnationals: The New Kids on the Block?

Global Research, April 30, 2007

by Kavaljit Singh

The mid-1990s witnessed the dramatic emergence of transnational corporations from the developing world. Although much of the investment by these corporations is concentrated in other developing countries (South-South), they are increasingly investing heavily in developed countries (South-North) as well. The South-South and South-North FDI flows are growing much faster than the traditional North-South FDI flows. However, 87 per cent of the total outward FDI flows in 2004 originated from just 10 developing countries.

In terms of foreign assets, the majority of top 50 Southern TNCs are headquartered in Asia (32), followed by Latin America (11) and Africa (7, all of them in South Africa ). What is interesting to note is that the increase in FDI outflows is concentrated in many of the same countries that receive the bulk of FDI inflows to developing countries such as China , Brazil , India , South Africa , and Mexico . Outward FDI from China increased from a meager $400 million in 1980 to $38 billion by the end of 2004. China is also the second largest investor in Africa, after the US . In the case of India , there were 136 outward investment deals valued at $4.3 billion in 2005. The value of outward foreign investment by Indian firms almost nears the level of inward foreign investment. With the lifting of international sanctions and the relaxation of capital controls, South African TNCs such as the Anglo American Corporation, De Beers, and SABMiller have become dominant players in the African region. In the words of Graham Mackay, CEO of SABMiller, “If there was any more of Africa , we would be investing in it. The return on investments here ( Africa ) has been fantastic.” [1]

The motivations behind cross-border investments by Southern TNCs are not different from others. To a large extent, competition pressures arising from globalization processes (such as liberalization of imports and inward FDI) drive Southern corporations to invest abroad. Like their Northern counterparts, the Southern TNCs are investing abroad to gain access to natural resources, markets, skills, and technology. In some recent cases, acquiring brand names (such as the acquisition of IBM’s personal computer division by China ’s Lenovo) seems to be the prime motive.

To a large extent, the expansion of South-South and South-North investment flows reflects the increasing integration of developing countries into the world economy. A number of important factors including regional integration through trade and investment agreements, trade and financial liberalization, increasing wealth as well as limited market size and resource base at home have encouraged Southern TNCs to invest abroad.

Instead of investing in greenfield projects, however, Southern transnationals are increasingly undertaking investments through acquisitions. Recently announced buyout deals (such as Beijing-based Lenovo’s purchase of IBM’s PC business and the acquisition by Mexican company Cemex of the UK ’s RMC) suggest that Southern TNCs are more actively engaged in M&A deals. The bulk of India ’s outward FDI is in the form of mergers and acquisitions, mainly in telecommunications, energy and pharmaceuticals. Even though most of the buyouts by Southern TNCs may still be under the billion dollar range, they portray an increasing outward orientation of big business in the developing world.

According to Joseph Battat and Dilek Aykut of the World Bank, South-South FDI increased from $15 billion in 1995 to $46 billion in 2003, accounting for some 35 per cent of total FDI flows in developing countries [2]. Despite their small size, South-South FDI flows are significant to many poor countries such as Lesotho , Mongolia , and Nepal . As far as South-North FDI flows are concerned, OECD countries received $16 billion of FDI in 2001, up from a mere $1 billion in 1995.

The bulk of South-South FDI flows are regional. For instance, nearly two-thirds of FDI into China originates in Hong Kong , Singapore , and Taiwan . Similarly, transnational corporations from Chile , Brazil , and Argentina operate largely in the Latin American region. Russian investments abroad have primarily been in the countries of the former Soviet Union while South African investments are almost completely located in Southern Africa .

In addition, the majority of South-South FDI flows are concentrated in the infrastructure and extractive sectors such as oil and gas. It is mainly state-owned corporations that dominate investments in these sectors. State-owned oil companies from China and India are rapidly acquiring oil and gas fields in Sub-Saharan Africa, Central Asia, and Latin America . For instance, almost half of China ’s outward FDI went to acquire natural resource projects in Latin America in 2004. Similarly, India ’s state-owned firm, Oil and Natural Gas Corporation, invested heavily in oil and gas fields in the Russian Federation and Angola .

Given that state-owned corporations are a significant source of South-South FDI flows (particularly in extractive industries and infrastructure), such investments may be driven not only by economic but also by political, strategic and diplomatic factors. The billions of dollars worth of investment by China in Africa is a case in point. The Chinese companies are involved in the building of oil refineries, dams, roads, and big infrastructure projects in several African countries including Sudan , Liberia , Angola , Chad , and Central African Republic . However, China ’s investments in Africa are not purely driven by economic factors. To some extent, such big investments also help China in earning international goodwill and securing political support for its own agenda, particularly to isolate Taiwan diplomatically (out of total 26 countries that have full diplomatic relations with Taiwan, seven belong to Africa).

It is interesting to note that outward investments by Southern TNCs are also supported by their respective governments through removal of capital controls, fiscal incentives, and investment protection measures. China , Malaysia , Thailand , and Singapore have created special mechanisms to provide preferential treatment and insurance against risks through credit guarantees schemes. For instance, the Chinese government adopted a policy (“Go Global”) in 2000 to encourage its firms to invest abroad. China ’s Export-Import Bank provides loans to firms for outward investments in resource development and infrastructure. If the investment is undertaken in an aid-recipient country, Chinese firms also receive preferential loans. Fiscal incentives are also provided to firms which bring machinery, plant, and equipment to their overseas ventures.

Some regional arrangements, such as the Southern African Development Community (SADC) and the Association of Southeast Asian Nations (ASEAN), also provide various incentives (including lower tax and tariff rates) for outward investment within the regions. Apart from fiscal and financial support, bilateral investment treaties and double taxation treaties between developing countries are growing.

To secure access to strategic assets, some Southern TNCs have also invested in developed countries such as Australia and Canada . In addition to the extractive and infrastructure sectors, there are also a few cases of large-scale South-North investments involving M&As. In particular, Chinese corporations have been active in acquiring several well-known consumer brand names, such as Thompson, RCA, and IBM.

Interestingly, tax havens are favorite destinations for many Southern TNCs as they are for Northern TNCs. The Cayman Islands, Bermuda, and Cyprus are the main destinations for Brazilian, Indian, and Russian outward FDI. Hong Kong plays an important role for the overseas expansion of Chinese corporations.

However, it needs to be emphasized here that some South-North investment deals have been subjected to intense political backlash in Northern countries. Several recent cross-border investment bids by Southern TNCs (for instance, the proposal by a Chinese company, China National Offshore Oil Corporation (CNOOC) to take over US oil company, Unocal) reflect growing unease among policy makers in the North.

Given the fact that most developing countries are usually capital importers, the rise of Southern TNCs poses new policy dilemmas. The policy makers in the developing world are increasingly finding it difficult to strike a balance between the country’s interest as a host country and its newly-found interests as a home country.

How should the new and growing phenomenon of outward FDI from the South be assessed? Are South-South FDI flows favorable to the host economy? Are the strategies and behaviors of Southern TNCs different from their Northern counterparts? Do Southern TNCs maintain better transparency, environmental, and labor standards than their Northern counterparts? What are the developmental impacts of investments by Southern TNCs? Who benefits from South-South investments? Who loses? Should South-South investment be promoted as an alternative to North-South investment flows? Unfortunately, the answers to such pertinent questions are hampered by the lack of in-depth studies and reliable data on South-South and South-North FDI flows. Despite such information gaps, one thing is certain: this new and growing phenomenon is going to play an important role in the global economy in the coming years.

Notes:

1. Remarks made by Graham Mackay at Africa Economic Summit 2005, Cape Town , June 1-3, 2005.

2. Joseph Battat and Dilek Aykut, “Southern Multinationals: A Growing Phenomenon,” note prepared for the conference, Southern Multinationals: A Rising Force in the World Economy, Mumbai, November 9-10, 2005.

Kavaljit Singh is Director, Public Interest Research Centre, New Delhi . He can be reached at kaval@vsnl.com. The above article is based on his latest report, Why Investment Matters: The Political Economy of International Investments (FERN, The Corner House, CRBM and Madhyam Books, 2007). The full report could be downloaded from: http://www.thecornerhouse.org.uk/pdf/document/Investment.pdf

Global Research, April 30, 2007

by Kavaljit Singh

The mid-1990s witnessed the dramatic emergence of transnational corporations from the developing world. Although much of the investment by these corporations is concentrated in other developing countries (South-South), they are increasingly investing heavily in developed countries (South-North) as well. The South-South and South-North FDI flows are growing much faster than the traditional North-South FDI flows. However, 87 per cent of the total outward FDI flows in 2004 originated from just 10 developing countries.

In terms of foreign assets, the majority of top 50 Southern TNCs are headquartered in Asia (32), followed by Latin America (11) and Africa (7, all of them in South Africa ). What is interesting to note is that the increase in FDI outflows is concentrated in many of the same countries that receive the bulk of FDI inflows to developing countries such as China , Brazil , India , South Africa , and Mexico . Outward FDI from China increased from a meager $400 million in 1980 to $38 billion by the end of 2004. China is also the second largest investor in Africa, after the US . In the case of India , there were 136 outward investment deals valued at $4.3 billion in 2005. The value of outward foreign investment by Indian firms almost nears the level of inward foreign investment. With the lifting of international sanctions and the relaxation of capital controls, South African TNCs such as the Anglo American Corporation, De Beers, and SABMiller have become dominant players in the African region. In the words of Graham Mackay, CEO of SABMiller, “If there was any more of Africa , we would be investing in it. The return on investments here ( Africa ) has been fantastic.” [1]

The motivations behind cross-border investments by Southern TNCs are not different from others. To a large extent, competition pressures arising from globalization processes (such as liberalization of imports and inward FDI) drive Southern corporations to invest abroad. Like their Northern counterparts, the Southern TNCs are investing abroad to gain access to natural resources, markets, skills, and technology. In some recent cases, acquiring brand names (such as the acquisition of IBM’s personal computer division by China ’s Lenovo) seems to be the prime motive.

To a large extent, the expansion of South-South and South-North investment flows reflects the increasing integration of developing countries into the world economy. A number of important factors including regional integration through trade and investment agreements, trade and financial liberalization, increasing wealth as well as limited market size and resource base at home have encouraged Southern TNCs to invest abroad.

Instead of investing in greenfield projects, however, Southern transnationals are increasingly undertaking investments through acquisitions. Recently announced buyout deals (such as Beijing-based Lenovo’s purchase of IBM’s PC business and the acquisition by Mexican company Cemex of the UK ’s RMC) suggest that Southern TNCs are more actively engaged in M&A deals. The bulk of India ’s outward FDI is in the form of mergers and acquisitions, mainly in telecommunications, energy and pharmaceuticals. Even though most of the buyouts by Southern TNCs may still be under the billion dollar range, they portray an increasing outward orientation of big business in the developing world.

According to Joseph Battat and Dilek Aykut of the World Bank, South-South FDI increased from $15 billion in 1995 to $46 billion in 2003, accounting for some 35 per cent of total FDI flows in developing countries [2]. Despite their small size, South-South FDI flows are significant to many poor countries such as Lesotho , Mongolia , and Nepal . As far as South-North FDI flows are concerned, OECD countries received $16 billion of FDI in 2001, up from a mere $1 billion in 1995.

The bulk of South-South FDI flows are regional. For instance, nearly two-thirds of FDI into China originates in Hong Kong , Singapore , and Taiwan . Similarly, transnational corporations from Chile , Brazil , and Argentina operate largely in the Latin American region. Russian investments abroad have primarily been in the countries of the former Soviet Union while South African investments are almost completely located in Southern Africa .

In addition, the majority of South-South FDI flows are concentrated in the infrastructure and extractive sectors such as oil and gas. It is mainly state-owned corporations that dominate investments in these sectors. State-owned oil companies from China and India are rapidly acquiring oil and gas fields in Sub-Saharan Africa, Central Asia, and Latin America . For instance, almost half of China ’s outward FDI went to acquire natural resource projects in Latin America in 2004. Similarly, India ’s state-owned firm, Oil and Natural Gas Corporation, invested heavily in oil and gas fields in the Russian Federation and Angola .

Given that state-owned corporations are a significant source of South-South FDI flows (particularly in extractive industries and infrastructure), such investments may be driven not only by economic but also by political, strategic and diplomatic factors. The billions of dollars worth of investment by China in Africa is a case in point. The Chinese companies are involved in the building of oil refineries, dams, roads, and big infrastructure projects in several African countries including Sudan , Liberia , Angola , Chad , and Central African Republic . However, China ’s investments in Africa are not purely driven by economic factors. To some extent, such big investments also help China in earning international goodwill and securing political support for its own agenda, particularly to isolate Taiwan diplomatically (out of total 26 countries that have full diplomatic relations with Taiwan, seven belong to Africa).

It is interesting to note that outward investments by Southern TNCs are also supported by their respective governments through removal of capital controls, fiscal incentives, and investment protection measures. China , Malaysia , Thailand , and Singapore have created special mechanisms to provide preferential treatment and insurance against risks through credit guarantees schemes. For instance, the Chinese government adopted a policy (“Go Global”) in 2000 to encourage its firms to invest abroad. China ’s Export-Import Bank provides loans to firms for outward investments in resource development and infrastructure. If the investment is undertaken in an aid-recipient country, Chinese firms also receive preferential loans. Fiscal incentives are also provided to firms which bring machinery, plant, and equipment to their overseas ventures.

Some regional arrangements, such as the Southern African Development Community (SADC) and the Association of Southeast Asian Nations (ASEAN), also provide various incentives (including lower tax and tariff rates) for outward investment within the regions. Apart from fiscal and financial support, bilateral investment treaties and double taxation treaties between developing countries are growing.

To secure access to strategic assets, some Southern TNCs have also invested in developed countries such as Australia and Canada . In addition to the extractive and infrastructure sectors, there are also a few cases of large-scale South-North investments involving M&As. In particular, Chinese corporations have been active in acquiring several well-known consumer brand names, such as Thompson, RCA, and IBM.

Interestingly, tax havens are favorite destinations for many Southern TNCs as they are for Northern TNCs. The Cayman Islands, Bermuda, and Cyprus are the main destinations for Brazilian, Indian, and Russian outward FDI. Hong Kong plays an important role for the overseas expansion of Chinese corporations.

However, it needs to be emphasized here that some South-North investment deals have been subjected to intense political backlash in Northern countries. Several recent cross-border investment bids by Southern TNCs (for instance, the proposal by a Chinese company, China National Offshore Oil Corporation (CNOOC) to take over US oil company, Unocal) reflect growing unease among policy makers in the North.

Given the fact that most developing countries are usually capital importers, the rise of Southern TNCs poses new policy dilemmas. The policy makers in the developing world are increasingly finding it difficult to strike a balance between the country’s interest as a host country and its newly-found interests as a home country.

How should the new and growing phenomenon of outward FDI from the South be assessed? Are South-South FDI flows favorable to the host economy? Are the strategies and behaviors of Southern TNCs different from their Northern counterparts? Do Southern TNCs maintain better transparency, environmental, and labor standards than their Northern counterparts? What are the developmental impacts of investments by Southern TNCs? Who benefits from South-South investments? Who loses? Should South-South investment be promoted as an alternative to North-South investment flows? Unfortunately, the answers to such pertinent questions are hampered by the lack of in-depth studies and reliable data on South-South and South-North FDI flows. Despite such information gaps, one thing is certain: this new and growing phenomenon is going to play an important role in the global economy in the coming years.

Notes:

1. Remarks made by Graham Mackay at Africa Economic Summit 2005, Cape Town , June 1-3, 2005.

2. Joseph Battat and Dilek Aykut, “Southern Multinationals: A Growing Phenomenon,” note prepared for the conference, Southern Multinationals: A Rising Force in the World Economy, Mumbai, November 9-10, 2005.

Kavaljit Singh is Director, Public Interest Research Centre, New Delhi . He can be reached at kaval@vsnl.com. The above article is based on his latest report, Why Investment Matters: The Political Economy of International Investments (FERN, The Corner House, CRBM and Madhyam Books, 2007). The full report could be downloaded from: http://www.thecornerhouse.org.uk/pdf/document/Investment.pdf

Sunday, May 20, 2007

Few more international than West Seti

Few more international than West Seti

eKantipur.com, 19-May-07

BY BIKASH SANGRAULA

After the end of this year's monsoon, the country's biggest ever infrastructure project, the 750-megawatt West Seti, will begin construction. But more than the size or cost (US $ 1.25 billion), it is the scale of international involvement that makes this project stand out among development ventures undertaken in Nepal.

The project has the involvement of four countries and two international banks in areas including investment, construction, insurance, transmission and consumption.

Australia's Snowy Mountain Engineering Corp (SMEC) took a decade to bring the storage-type project to the construction stage since signing a Project Agreement with the government of Nepal in June 1997 to develop and operate the project for 30 years.

"West Seti is a project that has been subject to particularly rigorous international analysis and review," said Bob Scott, SMEC chairman.

According to SMEC, the project will be owned by Chinese, Australian and Indian investors, apart from the government of Nepal and the Asian Development Bank (ADB).

A statement issued by SMEC after a shareholders' meeting in Kathmandu last week said that 26 percent of equity shares for the project will be owned by SMEC, and 15 percent each by China National and Machinery Import and Export Corporation (CMEC), ADB, the government of Nepal, and India's Infrastructure Leasing and Financial Services (IL&FS). Holders of the remaining 14 percent of shares will be finalized soon.

Similarly, on the debt financing side, China Exim Bank is investing US $ 400 m, IL&FS US $ 300 m, Bank of China US $ 300 m, the Industrial and Commercial Bank of China US $ 200 m, and ADB US $ 50 m, according to SMEC.

Meanwhile, political risk insurance is being sought from ADB, the China Export and Credit Insurance Corporation (Sinosure) and the Multilateral Investment Guarantee Agency (MIGA) of the World Bank. The project will be run by a company registered in Hong Kong.

Apart from ownership of equity shares, CMEC has been awarded the Plan, Design, and Build contract for the project.

Ninety percent of power generated from the project will be traded to India by PTC India Ltd, with which SMEC signed a 25-year Power Purchase Agreement in October 2003. Nepal will get the rest of the generated power as royalty.

According to SMEC, the construction of the project is expected to take 5.5 years, during which time an estimated US $ 225 million will be injected into Nepal's economy.

The project to be constructed in Doti district in Far Western Nepal will displace some 1,650 families from its reservoir area to the terai, while another 350 households within the transmission line area will also be affected, some of them needing relocation to adjacent land.

West Seti is designed to export power to northern India, where the peaking power deficit is estimated at about 12 percent.

eKantipur.com, 19-May-07

BY BIKASH SANGRAULA

After the end of this year's monsoon, the country's biggest ever infrastructure project, the 750-megawatt West Seti, will begin construction. But more than the size or cost (US $ 1.25 billion), it is the scale of international involvement that makes this project stand out among development ventures undertaken in Nepal.

The project has the involvement of four countries and two international banks in areas including investment, construction, insurance, transmission and consumption.

Australia's Snowy Mountain Engineering Corp (SMEC) took a decade to bring the storage-type project to the construction stage since signing a Project Agreement with the government of Nepal in June 1997 to develop and operate the project for 30 years.

"West Seti is a project that has been subject to particularly rigorous international analysis and review," said Bob Scott, SMEC chairman.

According to SMEC, the project will be owned by Chinese, Australian and Indian investors, apart from the government of Nepal and the Asian Development Bank (ADB).

A statement issued by SMEC after a shareholders' meeting in Kathmandu last week said that 26 percent of equity shares for the project will be owned by SMEC, and 15 percent each by China National and Machinery Import and Export Corporation (CMEC), ADB, the government of Nepal, and India's Infrastructure Leasing and Financial Services (IL&FS). Holders of the remaining 14 percent of shares will be finalized soon.

Similarly, on the debt financing side, China Exim Bank is investing US $ 400 m, IL&FS US $ 300 m, Bank of China US $ 300 m, the Industrial and Commercial Bank of China US $ 200 m, and ADB US $ 50 m, according to SMEC.

Meanwhile, political risk insurance is being sought from ADB, the China Export and Credit Insurance Corporation (Sinosure) and the Multilateral Investment Guarantee Agency (MIGA) of the World Bank. The project will be run by a company registered in Hong Kong.

Apart from ownership of equity shares, CMEC has been awarded the Plan, Design, and Build contract for the project.

Ninety percent of power generated from the project will be traded to India by PTC India Ltd, with which SMEC signed a 25-year Power Purchase Agreement in October 2003. Nepal will get the rest of the generated power as royalty.

According to SMEC, the construction of the project is expected to take 5.5 years, during which time an estimated US $ 225 million will be injected into Nepal's economy.

The project to be constructed in Doti district in Far Western Nepal will displace some 1,650 families from its reservoir area to the terai, while another 350 households within the transmission line area will also be affected, some of them needing relocation to adjacent land.

West Seti is designed to export power to northern India, where the peaking power deficit is estimated at about 12 percent.

Saturday, May 19, 2007

Roundup of Economic & Business News (May 12 - May 18)

May 12

PM requests India for normal petroleum supply (eKantipur.com)

No third party in valley's water distribution system: Yami (Nepalbiznews.com)

May 13

Schools shut down nationwide (eKantipur.com)

Fuel supply not yet smooth (eKantipur.com)

Maoists to return the seized properties (Nepalbiznews.com)

May 14

IOC doubles petrol supply (eKantipur.com)

Yami dismisses Severn Trent deadline (eKantipur.com)

Israel adopts ?wait and see? approach (eKantipur.com)

Casino Royal closed (eKantipur.com)

FDI commitment rises 56 pc (eKantipur.com)

Forthcoming budget to total Rs 160 billion (Nepalnews.com)

May 15

New building code for Valley unveiled (eKantipur.com)

IOC reduces petrol supply again (eKantipur.com)

Tribhuvan Highway to close during monsoon (eKantipur.com)

Government repays Rs 11.84 billion debt (eKantipur.com)

ID Bank to issue shares (eKantipur.com)

WWF grants Rs 7.8 million for biogas project (Nepalbiznews.com)

May 16

Privatization or no, NWSC badly needs reforms (eKantipur.com)

Hotel workers condemn Maoist excesses (eKantipur.com)

Nepal Airlines: Revamp or close down (eKantipur.com)

Cheaper wireless Internet from WorldLink (eKantipur.com)

Dillydallying jeopardizes Korean jobs for Nepalis (eKantipur.com)

‘Implement Insolvency Act soon’ (eKantipur.com)

Second Himalayan International Travel Mart concludes (Nepalbiznews.com)

All schools across the nation face indefinite shutdown (Nepalbiznews.com)

ADB to pull out from Melamchi; Minister Yami says she is not against the project

May 17

Finance ministry seeks to salvage Melamchi (eKantipur.com)

Maoists won't return lands before CA poll: Mahara (eKantipur.com)

Insecurity puts local development at risk (eKantipur.com)

NT's new 3G service receives good response (eKantipur.com)

High-level body to facilitate Nepal-Tibet trade (eKantipur.com)

NT to launch 3G mobile services (Nepalnews.com)

Direct flight to Europe from Nepal suspended (Xinhua)

May 18

ADB vice prez writes to Yami-Says Melamchi row may impact aid (eKantipur.com)

Hike in petroleum prices ruled out (eKantipur.com)

Asahi beer debuts (eKantipur.com)

Telecom regulator objects to 3G subscription fee (eKantipur.com)

(Nepalnews.com)

PM requests India for normal petroleum supply (eKantipur.com)

No third party in valley's water distribution system: Yami (Nepalbiznews.com)

May 13

Schools shut down nationwide (eKantipur.com)

Fuel supply not yet smooth (eKantipur.com)

Maoists to return the seized properties (Nepalbiznews.com)

May 14

IOC doubles petrol supply (eKantipur.com)

Yami dismisses Severn Trent deadline (eKantipur.com)

Israel adopts ?wait and see? approach (eKantipur.com)

Casino Royal closed (eKantipur.com)

FDI commitment rises 56 pc (eKantipur.com)

Forthcoming budget to total Rs 160 billion (Nepalnews.com)

May 15

New building code for Valley unveiled (eKantipur.com)

IOC reduces petrol supply again (eKantipur.com)

Tribhuvan Highway to close during monsoon (eKantipur.com)

Government repays Rs 11.84 billion debt (eKantipur.com)

ID Bank to issue shares (eKantipur.com)

WWF grants Rs 7.8 million for biogas project (Nepalbiznews.com)

May 16

Privatization or no, NWSC badly needs reforms (eKantipur.com)

Hotel workers condemn Maoist excesses (eKantipur.com)

Nepal Airlines: Revamp or close down (eKantipur.com)

Cheaper wireless Internet from WorldLink (eKantipur.com)

Dillydallying jeopardizes Korean jobs for Nepalis (eKantipur.com)

‘Implement Insolvency Act soon’ (eKantipur.com)

Second Himalayan International Travel Mart concludes (Nepalbiznews.com)

All schools across the nation face indefinite shutdown (Nepalbiznews.com)

ADB to pull out from Melamchi; Minister Yami says she is not against the project

May 17

Finance ministry seeks to salvage Melamchi (eKantipur.com)

Maoists won't return lands before CA poll: Mahara (eKantipur.com)

Insecurity puts local development at risk (eKantipur.com)

NT's new 3G service receives good response (eKantipur.com)

High-level body to facilitate Nepal-Tibet trade (eKantipur.com)

NT to launch 3G mobile services (Nepalnews.com)

Direct flight to Europe from Nepal suspended (Xinhua)

May 18

ADB vice prez writes to Yami-Says Melamchi row may impact aid (eKantipur.com)

Hike in petroleum prices ruled out (eKantipur.com)

Asahi beer debuts (eKantipur.com)

Telecom regulator objects to 3G subscription fee (eKantipur.com)

(Nepalnews.com)

Direct flight to Europe from Nepal suspended

Direct flight to Europe from Nepal suspended

Xinhua, 17-May-07

Austrian Airlines, the only airlines that directly links Nepal with Europe suspends its regular schedule flight from Thursday, local newspaper The Rising Nepal reported Thursday.

Austrian Airlines had taken this decision months ago mainly due to negative rate of return from Vienna-Kathmandu flight.

According to Bharat Basnet, general sales agent of Austrian Airlines to Nepal,

relatively higher price of aviation fuel, landing costs and other charges were responsible for the rise in the cost of operation in this sector.

The suspension of flights would cost more to Nepalese tourism industry, said Basnet while adding "It will have a multiplier plus multi-pronged effects."

Meanwhile, not only is the Nepal Airlines Corporation losing its regular income of nearly 12,000 U.S. dollars from ground-handling service at the moment, this would also cost the government and Nepali Oil Corporation substantial amount of revenue from sales and taxes.

More importantly, the country will lose the quality tourists from the United States of America (USA) and central European countries, said Basnet.

Meanwhile, the tourism entrepreneurs and hoteliers also opined that the suspension of Austrian Airlines flights was a great setback to Nepal's tourism industry.

Xinhua, 17-May-07

Austrian Airlines, the only airlines that directly links Nepal with Europe suspends its regular schedule flight from Thursday, local newspaper The Rising Nepal reported Thursday.

Austrian Airlines had taken this decision months ago mainly due to negative rate of return from Vienna-Kathmandu flight.

According to Bharat Basnet, general sales agent of Austrian Airlines to Nepal,

relatively higher price of aviation fuel, landing costs and other charges were responsible for the rise in the cost of operation in this sector.

The suspension of flights would cost more to Nepalese tourism industry, said Basnet while adding "It will have a multiplier plus multi-pronged effects."

Meanwhile, not only is the Nepal Airlines Corporation losing its regular income of nearly 12,000 U.S. dollars from ground-handling service at the moment, this would also cost the government and Nepali Oil Corporation substantial amount of revenue from sales and taxes.

More importantly, the country will lose the quality tourists from the United States of America (USA) and central European countries, said Basnet.

Meanwhile, the tourism entrepreneurs and hoteliers also opined that the suspension of Austrian Airlines flights was a great setback to Nepal's tourism industry.

Nepal Airlines: Revamp or close down

Nepal Airlines: Revamp or close down

eKantipur.com, 16-May-07

BY KRISHNA REGMI

There is a demand of air seats from passengers as well as supply of aircraft from manufacturers, yet fleet expansion of troubled national flag carrier has always been a pipedream.

Purchasing aircraft for Nepal Airlines Corporation (NAC) is like a political hot potato because of the previous controversial deals, in which power players lined their pockets.

Since the early 1990s, there were efforts to buy aircraft, but all of them ended just by forming a committee and submitting reports. It has been a routine for years: when a new minister at the Ministry Civil Aviation assumes office, he makes a loud proclamation to buy aircraft and constitute a committee. Still, the ill-fated NAC continues to languish with only a pair of over two-decade old aircraft.

Look at the one episode in a series of dramas that were staged in the past. In 1993, the corporation transferred over a dozen pilots from domestic sector to international to fly 'soon-to-arrive aircraft'. Even after 14 years no one knows what happened to the plan and why the new aircraft never showed up.

Its not that business opportunities are slim. In fact, NAC has immense potentials as indicated by facts that international airlines flying to Nepal are packed. In addition, many aspirant tourists are unable to travel just because they don't get air seats.

Arranging necessary financial resource is not a big deal as well. Financial institutions have already expressed their willingness to extend loans to purchase aircraft.

Because of the inefficient management and lack of commitment of successive tourism ministers, NAC is not only fighting the battle of its very existence but the whole tourism industry has also become a victim.

“Concerned NAC officials fear that they may be left out on the share of commissions. So they obstruct every effort to acquire aircraft,” said an official at the MoCTCA.

He said that the inefficient and incompetent management is the single biggest hurdle to NAC's fleet expansion.

The financial regulations of NAC endow its management full authority to execute all tasks pertaining to aircraft purchase, including preparation of a report on aircraft selection.

Around three years ago, then management tabled a proposal to the board to buy two Boeing-737 aircraft. “But, the board remained indecisive for months, as they were not sure about continuity of their tenures. They chose not to take risks by getting involved in the aircraft deal,” said the employee. “The lobby from rival Airbus agent might have also worked.”

The ministers also do not bother until they have a chance to install their staunch supporters to the top position at NAC, he said. He said there needs a greater reform on the management and most of its employees should be relieved of their jobs through volunteer retirement scheme to clear the way for aircraft purchase.

eKantipur.com, 16-May-07

BY KRISHNA REGMI

There is a demand of air seats from passengers as well as supply of aircraft from manufacturers, yet fleet expansion of troubled national flag carrier has always been a pipedream.

Purchasing aircraft for Nepal Airlines Corporation (NAC) is like a political hot potato because of the previous controversial deals, in which power players lined their pockets.

Since the early 1990s, there were efforts to buy aircraft, but all of them ended just by forming a committee and submitting reports. It has been a routine for years: when a new minister at the Ministry Civil Aviation assumes office, he makes a loud proclamation to buy aircraft and constitute a committee. Still, the ill-fated NAC continues to languish with only a pair of over two-decade old aircraft.

Look at the one episode in a series of dramas that were staged in the past. In 1993, the corporation transferred over a dozen pilots from domestic sector to international to fly 'soon-to-arrive aircraft'. Even after 14 years no one knows what happened to the plan and why the new aircraft never showed up.

Its not that business opportunities are slim. In fact, NAC has immense potentials as indicated by facts that international airlines flying to Nepal are packed. In addition, many aspirant tourists are unable to travel just because they don't get air seats.

Arranging necessary financial resource is not a big deal as well. Financial institutions have already expressed their willingness to extend loans to purchase aircraft.

Because of the inefficient management and lack of commitment of successive tourism ministers, NAC is not only fighting the battle of its very existence but the whole tourism industry has also become a victim.

“Concerned NAC officials fear that they may be left out on the share of commissions. So they obstruct every effort to acquire aircraft,” said an official at the MoCTCA.

He said that the inefficient and incompetent management is the single biggest hurdle to NAC's fleet expansion.

The financial regulations of NAC endow its management full authority to execute all tasks pertaining to aircraft purchase, including preparation of a report on aircraft selection.

Around three years ago, then management tabled a proposal to the board to buy two Boeing-737 aircraft. “But, the board remained indecisive for months, as they were not sure about continuity of their tenures. They chose not to take risks by getting involved in the aircraft deal,” said the employee. “The lobby from rival Airbus agent might have also worked.”

The ministers also do not bother until they have a chance to install their staunch supporters to the top position at NAC, he said. He said there needs a greater reform on the management and most of its employees should be relieved of their jobs through volunteer retirement scheme to clear the way for aircraft purchase.

Privatization or no, NWSC badly needs reforms

Privatization or no, NWSC badly needs reforms

eKantipur.com, 16-May-07

BY BIKASH SANGRAULA

It's over with Severn Trent if the deadline of May 15 set by the firm to the Ministry of Physical Planning and Works for award of Kathmandu Valley's water supply management contract means anything.

Minister Yami, who halted the contract award to "review" the previous government's decision to award it to the firm, is busy with damage mitigation. The Asian Development Bank (ADB) had backed the deadline by outlining the possible unfolding of events in case of non-award of the contract - a gradual withdrawal by the bank from Melamchi project.

Sources at Kathmandu Upatyeka Khanepani Ltd (KUKL), a water utility operator formed by the previous government, which was supposed to hire Severn Trent, say that in all likelihood KUKL will now be managing the Valley's water supply system on its own.

But how well equipped is KUKL to reform a public utility which has the unenviable reputation of being an over-staffed political recruitment center, with 40 percent leakage, and arrears more than annual revenue?

Nepal Water Supply Corporation (NWSC), which is ceding rights to manage Kathmandu Valley's water supply to KUKL, has total arrears of over Rs 810 million, of which Kathmandu Valley contributes Rs 690 million. NWSC's annual revenue is approximately Rs 720 million, including from towns and cities outside the Valley. Even out of this, 20 percent is invariably added to arrears every year, going by the trend of several decades.

"We still don't have records of many taps that have continued to receive free water supply since before 1974, when the Valley's water supply was overseen by Khanepani Goswara," said one highly placed NWSC official. "And many arrear accounts that feature in our list might not exist anymore. The taps might have been dismantled. We don't know."

Collecting arrears has been problematic. Disconnecting supply of something as essential as water only invites public outcry, which almost always has to be settled "politically", meaning partial or no payment at all. "In recent years, the supply scenario has been so poor that our staff get beaten up for asking payment of backdated bills," the official said.

Officials admit that the corporation is overstaffed. "There are too many non-productive administrative posts," said an official. "On the other hand, there is real dearth of technical manpower." Currently, there are some 2,252 employees at the corporation.

Another area of concern is that the leakage figure of 40 percent is a guesstimate at best. Granting that leakages from the century-old distribution system is not worse, then actual supply in the Valley during dry season is only 60 million liters daily (MLD), 40 percent less than the generation of 100 MLD. The Valley's demand, on the other hand, is 250 MLD.

"It is true that the utility badly needs an overhaul," said NWSC Deputy General Manager Madan Shanker Shrestha. "The problem is that every promise of infrastructure overhaul comes with tied conditions of prior institutional overhaul. And the latter too gets stuck at some stage."

In 33 years since the establishment of Water Supply and Sewerage Board, which later graduated to the status of corporation, millions of dollars have been spent, not to overhaul the system, reduce leakage and arrears and rightsize the utility, but to increase water availability. Some 93 million dollars were spent in grant, loan and technical assistance from 1990 to 1999 alone.

If ADB stays with the project, some 83 million dollars will be spent in the Kathmandu Valley component of the project, which includes distribution system improvement. But who will spend this fund? KUKL is owned by the government (30 percent), municipalities (50 percent), NCC and FNCCI (15 percent) and employees (5 percent). What we can reasonably expect from them is a tricky question.

eKantipur.com, 16-May-07

BY BIKASH SANGRAULA

It's over with Severn Trent if the deadline of May 15 set by the firm to the Ministry of Physical Planning and Works for award of Kathmandu Valley's water supply management contract means anything.

Minister Yami, who halted the contract award to "review" the previous government's decision to award it to the firm, is busy with damage mitigation. The Asian Development Bank (ADB) had backed the deadline by outlining the possible unfolding of events in case of non-award of the contract - a gradual withdrawal by the bank from Melamchi project.

Sources at Kathmandu Upatyeka Khanepani Ltd (KUKL), a water utility operator formed by the previous government, which was supposed to hire Severn Trent, say that in all likelihood KUKL will now be managing the Valley's water supply system on its own.

But how well equipped is KUKL to reform a public utility which has the unenviable reputation of being an over-staffed political recruitment center, with 40 percent leakage, and arrears more than annual revenue?

Nepal Water Supply Corporation (NWSC), which is ceding rights to manage Kathmandu Valley's water supply to KUKL, has total arrears of over Rs 810 million, of which Kathmandu Valley contributes Rs 690 million. NWSC's annual revenue is approximately Rs 720 million, including from towns and cities outside the Valley. Even out of this, 20 percent is invariably added to arrears every year, going by the trend of several decades.

"We still don't have records of many taps that have continued to receive free water supply since before 1974, when the Valley's water supply was overseen by Khanepani Goswara," said one highly placed NWSC official. "And many arrear accounts that feature in our list might not exist anymore. The taps might have been dismantled. We don't know."

Collecting arrears has been problematic. Disconnecting supply of something as essential as water only invites public outcry, which almost always has to be settled "politically", meaning partial or no payment at all. "In recent years, the supply scenario has been so poor that our staff get beaten up for asking payment of backdated bills," the official said.

Officials admit that the corporation is overstaffed. "There are too many non-productive administrative posts," said an official. "On the other hand, there is real dearth of technical manpower." Currently, there are some 2,252 employees at the corporation.

Another area of concern is that the leakage figure of 40 percent is a guesstimate at best. Granting that leakages from the century-old distribution system is not worse, then actual supply in the Valley during dry season is only 60 million liters daily (MLD), 40 percent less than the generation of 100 MLD. The Valley's demand, on the other hand, is 250 MLD.

"It is true that the utility badly needs an overhaul," said NWSC Deputy General Manager Madan Shanker Shrestha. "The problem is that every promise of infrastructure overhaul comes with tied conditions of prior institutional overhaul. And the latter too gets stuck at some stage."

In 33 years since the establishment of Water Supply and Sewerage Board, which later graduated to the status of corporation, millions of dollars have been spent, not to overhaul the system, reduce leakage and arrears and rightsize the utility, but to increase water availability. Some 93 million dollars were spent in grant, loan and technical assistance from 1990 to 1999 alone.

If ADB stays with the project, some 83 million dollars will be spent in the Kathmandu Valley component of the project, which includes distribution system improvement. But who will spend this fund? KUKL is owned by the government (30 percent), municipalities (50 percent), NCC and FNCCI (15 percent) and employees (5 percent). What we can reasonably expect from them is a tricky question.

New building code for Valley unveiled

New building code for Valley unveiled

eKantipur.com, 15-May-07

The government has unveiled a new building code that comes into effect from Tuesday in all the municipalities and urbanizing Village Development Committees (VDCs) of Kathmandu Valley.

Officials at the Ministry of Physical Planning and Construction (MoPPC) said the code, among other things, aims at checking the fragmentation of land used for construction of residential and other types of buildings.

Talking to the Post, Kishor Jung Karki, deputy spokesperson at the ministry, said the newly unveiled building code has a provision allowing 70 percent ground coverage in commercial sub-areas and 80 percent in residential sub-areas for up to 8 anna of land, i.e. 2,738 sq. ft., while carrying out new constructions.

The existing code formulated 14 years ago had a provision allowing 70 percent ground coverage for 2.2 to 4 anna ( 752.95 to 1,369 sq. ft), 60 percent for 4 to 8 anna (1,369 to 2,738 sq ft) and 50 percent for above 8 anna ( 2,738 Sq ft). "The provision of allowing more ground coverage for smaller pieces of land had given rise to fragmentation. The new provision will certainly do away with that practice," said Karki.

There are one metropolis, one sub-metropolis, three municipalities and 45 urbanizing VDCs in the Valley. The Valley has seen an unprecedented population boom in the last 15 years, particularly after the Maoists launched their armed insurgency in 1996.

The building code approved by the cabinet recently has made it mandatory to leave at least three meters of open space on all sides of government, semi-government, commercial and industrial buildings. The code has also made it mandatory for commercial and industrial buildings to have adequate parking facilities.

According to MoPPC, the owners of a commercial complex spread over 2,000 square feet will have to ensure at least 684.5 Sq ft for parking purposes. These complexes are also required to develop underground parking facilities.

Likewise, the building code allows people to construct up to 30 feet high in areas lying beyond 300 meters from the compound of the Royal Palace. Earlier, the authorities restricted construction height in these areas to 15 feet. With this decision, locals of these areas will be able to add at least one more storey to their houses.

The building code recognizes Dasharath Stadium, Tundikhel, the Army Pavillion, Ratna Park, Rani Pokhari and Bhrikuti Mandap as green zones. The government has a plan to remove all residential buildings from these areas to develop them as green zones.

eKantipur.com, 15-May-07

The government has unveiled a new building code that comes into effect from Tuesday in all the municipalities and urbanizing Village Development Committees (VDCs) of Kathmandu Valley.

Officials at the Ministry of Physical Planning and Construction (MoPPC) said the code, among other things, aims at checking the fragmentation of land used for construction of residential and other types of buildings.

Talking to the Post, Kishor Jung Karki, deputy spokesperson at the ministry, said the newly unveiled building code has a provision allowing 70 percent ground coverage in commercial sub-areas and 80 percent in residential sub-areas for up to 8 anna of land, i.e. 2,738 sq. ft., while carrying out new constructions.

The existing code formulated 14 years ago had a provision allowing 70 percent ground coverage for 2.2 to 4 anna ( 752.95 to 1,369 sq. ft), 60 percent for 4 to 8 anna (1,369 to 2,738 sq ft) and 50 percent for above 8 anna ( 2,738 Sq ft). "The provision of allowing more ground coverage for smaller pieces of land had given rise to fragmentation. The new provision will certainly do away with that practice," said Karki.

There are one metropolis, one sub-metropolis, three municipalities and 45 urbanizing VDCs in the Valley. The Valley has seen an unprecedented population boom in the last 15 years, particularly after the Maoists launched their armed insurgency in 1996.

The building code approved by the cabinet recently has made it mandatory to leave at least three meters of open space on all sides of government, semi-government, commercial and industrial buildings. The code has also made it mandatory for commercial and industrial buildings to have adequate parking facilities.

According to MoPPC, the owners of a commercial complex spread over 2,000 square feet will have to ensure at least 684.5 Sq ft for parking purposes. These complexes are also required to develop underground parking facilities.

Likewise, the building code allows people to construct up to 30 feet high in areas lying beyond 300 meters from the compound of the Royal Palace. Earlier, the authorities restricted construction height in these areas to 15 feet. With this decision, locals of these areas will be able to add at least one more storey to their houses.

The building code recognizes Dasharath Stadium, Tundikhel, the Army Pavillion, Ratna Park, Rani Pokhari and Bhrikuti Mandap as green zones. The government has a plan to remove all residential buildings from these areas to develop them as green zones.

FDI commitment rises 56 percent

FDI commitment rises 56 percent

eKantipur.com, 14-May-07

As peace and democracy prevail in the country, foreign direct investment commitment to Nepal has recorded a 56 percent rise during the first nine months of the current fiscal year.

Report of Department of Industry (DoI) says Nepal received a FDI commitment of Rs 2.45 billion during the period, whereas it was Rs 1.56 billion in the same period last year.

However, challenges lie ahead in materializing the FDI commitments into reality, economists said.

The rise in volume of commitment is a good sign,� said Dr Dilli Raj Khanal, economist and lawmaker of CPN-UML. �It is, however, vital that we convert the commitment into actual investments,� he told the Post.

DoI record shows that one-third of the FDI commitments received in a year never enter the country due to political instability, labor stir and bureaucratic red tape.

And the incoming two third FDI projects also take at least two years to come into operation. In such a situation, DOI officials said stronger reform was needed to take benefits of the FDI potential.

The DoI has approved 121 FDI projects during the nine months of 2006/07, which is higher than the number (86 projects) recorded during the same period last year.

Officials stated investors could shy away from coming in the country if the government did not act strongly in enforcing much-committed reforms in Labor Act, industrial and trade policy, Industrial Enterprise Act and Foreign Investment and Technology Transfer Act.

Dr Khanal also noted that labor stir, which impacted industrial operations severely in the past months, could send a negative signal abroad. �Situation like that must be averted,� said he.

He also laid emphasis on the need to foster investment climate in order to create more employment opportunities in line with the aspiration of Janaandolan II.

�On the positive side, we have presently secured more FDI commitment in the manufacturing sector, which is the largest generator of employment compared to other sectors. It is up to the political leadership to ensure that those investments do not shy away from the country,� said a DoI official.

Statistics of DoI shows Nepal received maximum FDI commitment, totaling to Rs 1.28 billion in the manufacturing sector. Likewise, FDI commitment of over Rs 940 million has come for 56 projects under the service sector.

Tourism industry has also managed to secure FDI commitment of over Rs 150 million during the period.

eKantipur.com, 14-May-07

As peace and democracy prevail in the country, foreign direct investment commitment to Nepal has recorded a 56 percent rise during the first nine months of the current fiscal year.

Report of Department of Industry (DoI) says Nepal received a FDI commitment of Rs 2.45 billion during the period, whereas it was Rs 1.56 billion in the same period last year.

However, challenges lie ahead in materializing the FDI commitments into reality, economists said.

The rise in volume of commitment is a good sign,� said Dr Dilli Raj Khanal, economist and lawmaker of CPN-UML. �It is, however, vital that we convert the commitment into actual investments,� he told the Post.

DoI record shows that one-third of the FDI commitments received in a year never enter the country due to political instability, labor stir and bureaucratic red tape.

And the incoming two third FDI projects also take at least two years to come into operation. In such a situation, DOI officials said stronger reform was needed to take benefits of the FDI potential.